The country’s imports hit a three-year high in July this year, as the economy continued to recover from the dollar crisis that had forced authorities to scale back purchases from abroad.

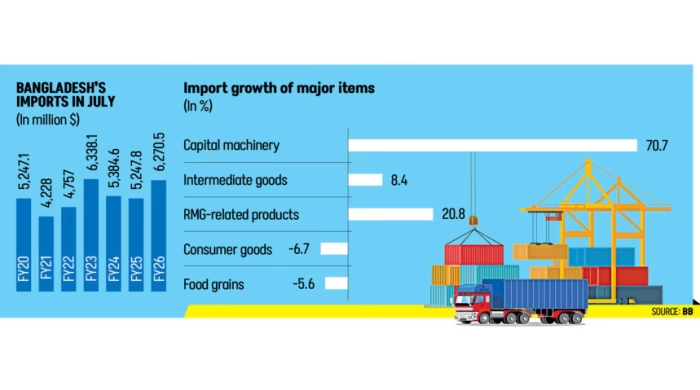

Importers brought in goods worth $6.2 billion in July, up 19.5 percent in the same month a year earlier, according to data from the National Board of Revenue (NBR) compiled by the Bangladesh Bank (BB).

Bangladesh imported goods worth $6.3 billion in July 2023. Since then, imports had fallen before recovering this year.

Business leaders said the low base of July last year, when trade was disrupted by the mass uprising against the Sheikh Hasina-led government, partly explains the sharp rise. They pointed to a return to normal business activity after last year’s unrest as a key driver.

The latest increase was driven by higher imports of intermediate goods, especially ready-made garments (RMG) inputs, iron, steel and other base metals, as well as capital machinery.

Mahia Juned, additional managing director of City Bank PLC, said Bangladesh’s higher import payments this fiscal year are mainly the result of a rebound in industrial demand, especially for capital machinery and intermediate goods, following the relaxation of earlier restrictions.

“For much of the past two years, authorities had curbed imports by tightening LC approvals and requiring high cash margins to protect foreign reserves. With some of those curbs relaxed, businesses are now importing essential inputs, while elevated global prices and a weaker taka have further inflated the bill,” she said.

“Overall, the increase is rooted in investment and production needs rather than consumer demand,” she added.

Kamran T Rahman, president of the Metropolitan Chamber of Commerce & Industry, Dhaka (MCCI), said the noticeable rise in imports, particularly of capital machinery, signals a positive shift in industrial sentiment.

“However, this data must be interpreted with caution,” said Rahman.

He said that July and August last year were marked by unrest and operational disruptions, including port closures, which distorted import clearance and customs figures.

Anwar-Ul-Alam Chowdhury, president of the Bangladesh Chamber of Industries (BCI), echoed similar views.

Usually, any comparison between this July and the same period last year may show a sharp increase, said the BCI president. “But that does not necessarily indicate real growth. It simply reflects a return to regular operations.”

He added that private sector investment and letter of credit (LC) openings remain weak and that capital machinery imports have been declining for several fiscal years.

Credit to businesses grew 6.52 percent in July, a slight rise from the previous month. Still, this was the second-lowest growth in private-sector credit, which accounts for two-thirds of national investment, in at least one and a half years.

“Credit growth figures tell a cautious story, showing limited investment appetite. So, while the numbers may look positive at first glance, we must recognise that the economy is still in a phase of stabilisation, not expansion,” he added.

Mir Nasir Hossain, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), said the spike in imports reflects renewed industrial momentum, pointing to the increase in RMG-related and capital goods.

Data show that imports of intermediate goods, including RMG inputs, rose 21 percent year-on-year to $3.84 billion in July. Capital machinery imports, which had been in decline, rose 71 percent to $456 million.

RMG-related imports grew 10.3 percent to $1.52 billion in July this year compared to the month a year ago.

A key factor behind this recovery is that some factories have finally received gas connections after years of waiting, enabling them to start production, said Hossain.

At the same time, Bangladesh is under pressure to maintain employment and meet growing domestic demand across sectors. However, infrastructure challenges, particularly in power and energy, remain a barrier, added the former FBCCI president.

Ashraf Ahmed, a former president of the Dhaka Chamber of Commerce & Industry (DCCI), said the import data indicates a weaker demand for consumer goods, including food, possibly due to persistent inflation.

On the other hand, the rising import of capital machinery and intermediates signals an easing of the import regime as well as recovery from political instability and shutdowns in July 2024, he said.

Ahmed added that one worrying trend is the fall in raw cotton imports alongside a rise in yarn imports, which points to a loss of market share by local manufacturers.