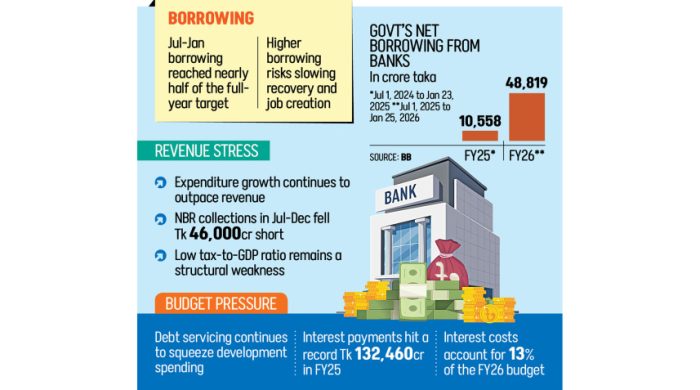

The interim government’s net borrowing from the banking system rose almost fivefold in the first seven months of the current fiscal year 2025-26, as spending raced ahead of sluggish revenue collection.The government borrowed Tk 48,819 crore from banks as of January 25, compared with Tk 10,558 crore by January 23 last year, according to Bangladesh Bank (BB) provisional data.The amount already accounts for nearly half of the full year’s borrowing target of Tk 104,000 crore.The sharp rise reflects a widening gap between expenditure and income. Government spending has climbed steadily, while revenue collection has failed to keep pace.The National Board of Revenue posted a 14 percent year-on-year growth in collection in the first six months of FY26, mobilising Tk 185,229 crore. Even so, receipts fell short of the target by about Tk 46,000 crore.

In the same period last year, revenue slipped by 1 percent amid unrest following the political changeover in August 2024.

“This is not a sustainable situation,” said Fahmida Khatun, executive director of private think-tank the Centre for Policy Dialogue (CPD).She said weak domestic resource mobilisation pushes debt levels higher and leaves little room to manage day-to-day spending. “The revenue collection remains so low that it is difficult to manage regular expenditure.”

According to the economist, the country’s persistently low tax-to-GDP ratio has made the government increasingly reliant on bank borrowing, driving up debt and interest payments.FY25, interest payments reached a record Tk 132,460 crore, almost one-fifth of total budget spending, according to the finance ministry’s debt bulletin.

For the current year, interest costs stand at Tk 122,000 crore, accounting for 13 percent of the budget.

As debt servicing takes up a larger share of public funds, allocations for education, health and infrastructure are squeezed, undermining long-term growth prospects.

Fahmida said that unless tax collection grows fast, heavier government borrowing from banks will also tighten credit for the private sector.

Ashikur Rahman, principal economist at the Policy Research Institute (PRI), warned that a risky cycle is beginning to take hold.

Higher borrowing, he said, feeds directly into a growing interest burden within the fiscal framework.

“As debt servicing absorbs a larger share of public expenditure, fiscal space for productivity-enhancing investments, particularly in human capital, health, education, and critical infrastructure, shrinks,” he explained.

Over time, this trade-off weakens the state’s ability to address structural development constraints and undermines the quality of growth itself, said Rahman.

Rising government demand for credit also crowds out private firms, pushing up borrowing costs and discouraging investment.

“This is particularly concerning at a time when economic recovery and employment generation depend critically on a revival of private sector confidence and investment momentum,” he added.

The persistence of high borrowing also points to deeper weaknesses on the revenue side. Despite some gains, collections remain far below what is needed to finance public spending in a sustainable way.

“This points to longstanding deficiencies in tax policy design, tax administration, and compliance. Without a durable improvement in domestic resource mobilisation, borrowing risks becoming a default adjustment mechanism rather than a temporary counter-cyclical tool,” he said.

Breaking the cycle, Rahman said, will require prudent debt management alongside credible revenue reforms and a clear medium-term fiscal strategy that shifts spending towards growth-enhancing priorities rather than debt servicing.

More pressure is expected in the months ahead. The rollout of a new pay scale for government employees will require an additional Tk 106,000 crore, around one-fifth of total operating expenditure for the year.

CPD’s Fahmida suggested the increases should be phased in.

Otherwise, she said, maintaining fiscal balance will become one of the toughest challenges for the next government.